Bitcoin (abbreviation: BTC; sign: ₿) is a decentralized digital currency that can be transferred on the peer-to-peer bitcoin network.[7] Bitcoin transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. The cryptocurrency was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto.[10] The currency began use in 2009,[11] when its implementation was released as open-source software.[6]: ch. 1

Bitcoin

Prevailing bitcoin logo

Denominations

Plural

bitcoins

Symbol

₿ (Unicode: U+20BF ₿ BITCOIN SIGN)[a]

Code

BTC,[b] XBT[c]

Precision

10−8

Subunits

1⁄1000

millibitcoin

1⁄1000000

microbitcoin

1⁄100000000

satoshi[2]

Development

Original author(s)

Satoshi Nakamoto

White paper

“Bitcoin: A Peer-to-Peer Electronic Cash System”[4]

Implementation(s)

Bitcoin Core

Initial release

0.1.0 / 9 January 2009 (13 years ago)

Latest release

23.0 / 25 April 2022 (5 months ago)[3]

Code repository

github.com/bitcoin/bitcoin

Development status

Active

Source model

Free and open-source software

License

MIT License

Website

bitcoin.org

Ledger

Ledger start

3 January 2009 (13 years ago)

Timestamping scheme

Proof-of-work (partial hash inversion)

Hash function

SHA-256 (two rounds)

Issuance schedule

Decentralized (block reward)

Initially ₿50 per block, halved every 210,000 blocks[7]

Block reward

₿6.25[d]

Block time

10 minutes

Circulating supply

₿18,925,000[e]

Supply limit

₿21,000,000[5][f]

Valuation

Exchange rate

Floating

Market cap

US$352 billion (2022-06-18, highly volatile)

Demographics

Official user(s)

El Salvador[8]

Central African Republic[9]

The symbol was encoded in Unicode version 10.0 at position U+20BF ₿ BITCOIN SIGN in the Currency Symbols block in June 2017.[1]

Very early software versions used the code “BC”.

Compatible with ISO 4217.

May 2020 to approximately 2024, halved approximately every four years

As of 2022-01-10

The supply will approach, but never reach, ₿21 million. Issuance will permanently halt c. 2140 at ₿20,999,999.9769.[6]: ch. 8

This article contains special characters. Without proper rendering support, you may see question marks, boxes, or other symbols.

The word bitcoin was defined in a white paper published on 31 October 2008.[4][12] It is a compound of the words bit and coin.[13] No uniform convention for bitcoin capitalization exists; some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, for the unit of account.[14] The Wall Street Journal,[15] The Chronicle of Higher Education,[16] and the Oxford English Dictionary[13] advocate the use of lowercase bitcoin in all cases.

The legality of bitcoin varies by region. Nine countries have fully banned bitcoin use, while a further fifteen have implicitly banned it. A few governments have used bitcoin in some capacity. El Salvador has adopted Bitcoin as legal tender, although use by merchants remains low. Ukraine has accepted cryptocurrency donations to fund the resistance to the 2022 Russian invasion. Iran has used bitcoin to bypass sanctions.

Bitcoin has been described as an economic bubble by at least eight Nobel Memorial Prize in Economic Sciences recipients.[17]

DESIGN

Units and divisibility

The unit of account of the bitcoin system is the bitcoin. Currency codes for representing bitcoin are BTC[a] and XBT.[b][21]: 2 Its Unicode character is ₿.[1] One bitcoin is divisible to eight decimal places.[6]: ch. 5 Units for smaller amounts of bitcoin are the millibitcoin (mBTC), equal to 1⁄1000 bitcoin, and the satoshi (sat), which is the smallest possible division, and named in homage to bitcoin’s creator, representing 1⁄100000000 (one hundred millionth) bitcoin.[2] 100,000 satoshis are one mBTC.[22]

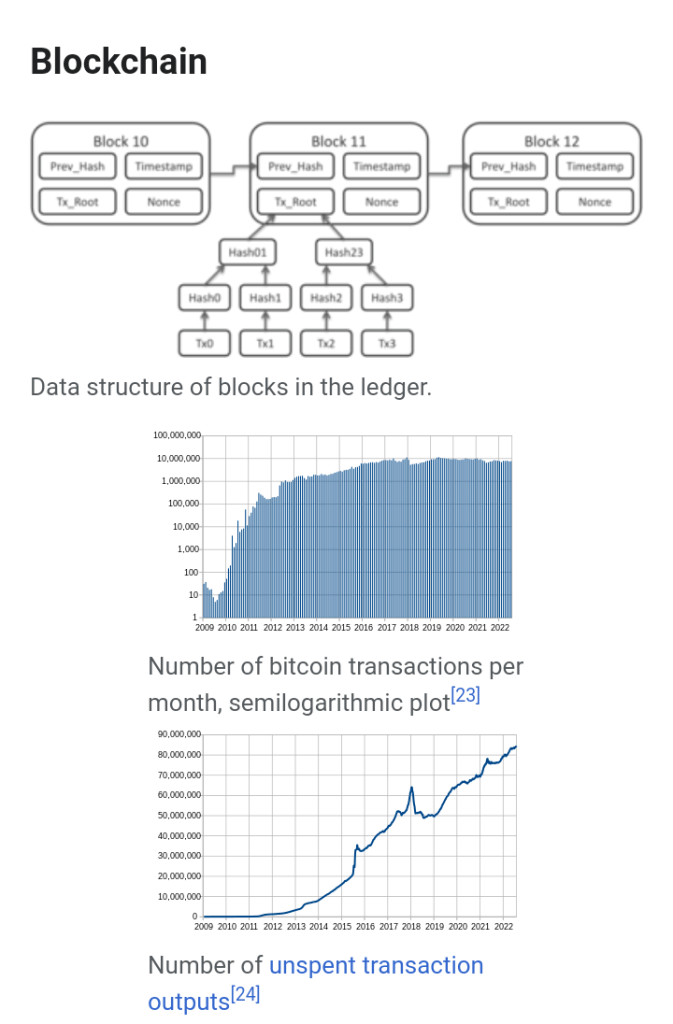

The bitcoin blockchain is a public ledger that records bitcoin transactions.[25] It is implemented as a chain of blocks, each block containing a cryptographic hash of the previous block up to the genesis block[c] in the chain. A network of communicating nodes running bitcoin software maintains the blockchain.[26]: 215–219 Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications.

Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. To achieve independent verification of the chain of ownership, each network node stores its own copy of the blockchain.[27] At varying intervals of time averaging to every 10 minutes, a new group of accepted transactions, called a block, is created, added to the blockchain, and quickly published to all nodes, without requiring central oversight. This allows bitcoin software to determine when a particular bitcoin was spent, which is needed to prevent double-spending. A conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, but the blockchain is the only place where bitcoins can be said to exist in the form of unspent outputs of transactions.[6]: ch. 5

Individual blocks, public addresses, and transactions within blocks can be examined using a blockchain explorer.[citation needed]

Transactions

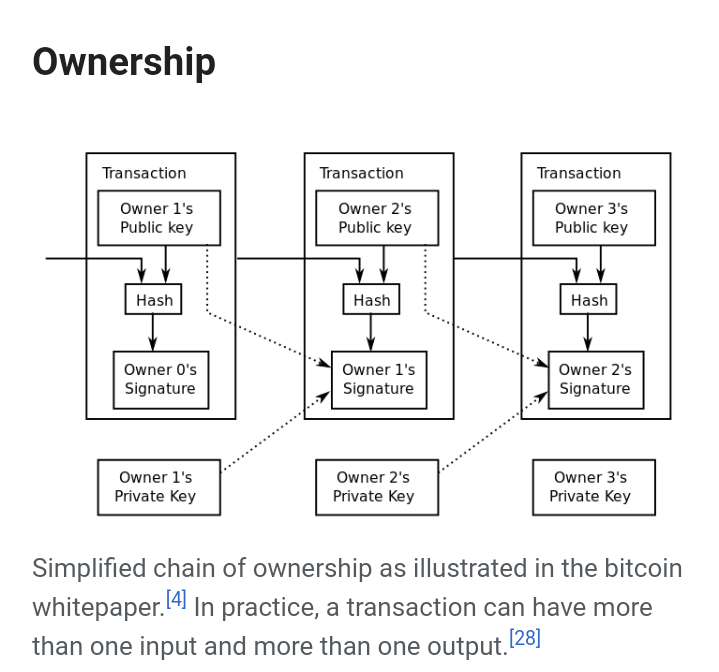

Transactions are defined using a Forth-like scripting language.[6]: ch. 5 Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain.[28] The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer.[28] Any input satoshis not accounted for in the transaction outputs become the transaction fee.[28]

Though transaction fees are optional, miners can choose which transactions to process and prioritize those that pay higher fees.[28] Miners may choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. These fees are generally measured in satoshis per byte (sat/b). The size of transactions is dependent on the number of inputs used to create the transaction and the number of outputs.[6]: ch. 8

The blocks in the blockchain were originally limited to 32 megabytes in size. The block size limit of one megabyte was introduced by Satoshi Nakamoto in 2010. Eventually, the block size limit of one megabyte created problems for transaction processing, such as increasing transaction fees and delayed processing of transactions.[29] Andreas Antonopoulos has stated Lightning Network is a potential scaling solution and referred to lightning as a second-layer routing network.[6]: ch. 8

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address requires nothing more than picking a random valid private key and computing the corresponding bitcoin address. This computation can be done in a split second. But the reverse, computing the private key of a given bitcoin address, is practically unfeasible.[6]: ch. 4 Users can tell others or make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used to compromise a private key. To be able to spend their bitcoins, the owner must know the corresponding private key and digitally sign the transaction.[d] The network verifies the signature using the public key; the private key is never revealed.[6]: ch. 5

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership;[26] the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost ₿7,500, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.[32] About 20% of all bitcoins are believed to be lost—they would have had a market value of about $20 billion at July 2018 prices.[33]

To ensure the security of bitcoins, the private key must be kept secret.[6]: ch. 10 If the private key is revealed to a third party, e.g. through a data breach, the third party can use it to steal any associated bitcoins.[34] As of December 2017, around ₿980,000 have been stolen from cryptocurrency exchanges.[35]

Regarding ownership distribution, as of 16 March 2018, 0.5% of bitcoin wallets own 87% of all bitcoins ever mined.[36]

MINING

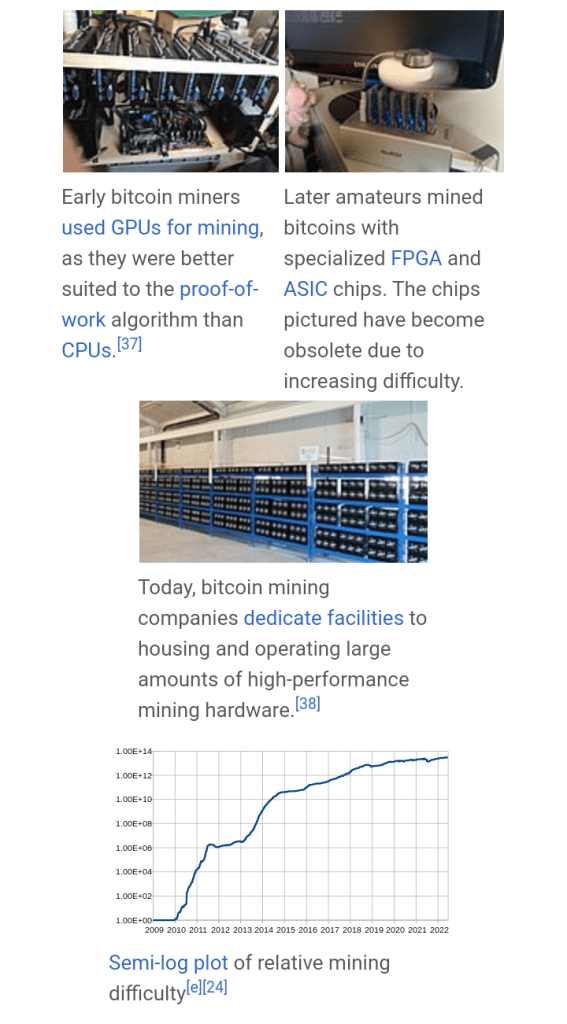

Mining is a record-keeping service done through the use of computer processing power.[f] Miners keep the blockchain consistent, complete, and unalterable by repeatedly grouping newly broadcast transactions into a block, which is then broadcast to the network and verified by recipient nodes.[25] Each block contains a SHA-256 cryptographic hash of the previous block,[25] thus linking it to the previous block and giving the blockchain its name.[6]: ch. 7 [25]

To be accepted by the rest of the network, a new block must contain a proof-of-work (PoW).[25][g] The PoW requires miners to find a number called a nonce (a number used just once), such that when the block content is hashed along with the nonce, the result is numerically smaller than the network’s difficulty target.[6]: ch. 8 This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is the ascending natural numbers: 0, 1, 2, 3, …) before a result happens to be less than the difficulty target. Because the difficulty target is extremely small compared to a typical SHA-256 hash, block hashes have many leading zeros[6]: ch. 8 as can be seen in this example block hash:

0000000000000000000590fc0f3eba193a278534220b2b37e9849e1a770ca959

By adjusting this difficulty target, the amount of work needed to generate a block can be changed. Every 2,016 blocks (approximately 14 days given roughly 10 minutes per block), nodes deterministically adjust the difficulty target based on the recent rate of block generation, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.[6]: ch. 8 As of April 2022, it takes on average 122 sextillion (122 thousand billion billion) attempts to generate a block hash smaller than the difficulty target.[41] Computations of this magnitude are extremely expensive and utilize specialized hardware.[42]

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.[43] As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.[25]

Computing power is often bundled together by a Mining pool to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block.[44]

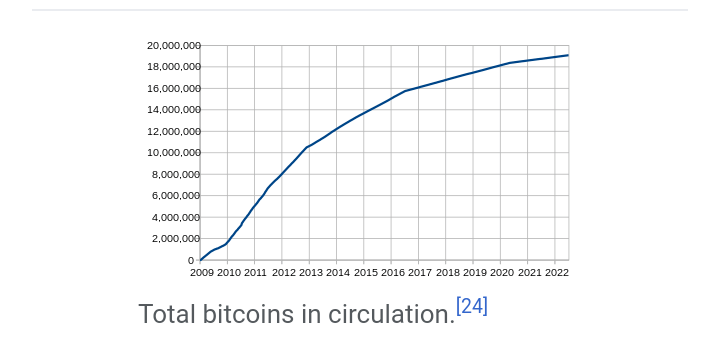

SUPPLY

The successful miner finding the new block is allowed by the rest of the network to collect for themselves all transaction fees from transactions they included in the block, as well as a predetermined reward of newly created bitcoins.[45] As of 11 May 2020, this reward is currently ₿6.25 in newly created bitcoins per block.[46] To claim this reward, a special transaction called a coinbase is included in the block, with the miner as the payee.[6]: ch. 8 All bitcoins in existence have been created through this type of transaction. The bitcoin protocol specifies that the reward for adding a block will be reduced by half every 210,000 blocks (approximately every four years). Eventually, the reward will round down to zero, and the limit of ₿21 million[h] is expected to be reached c. 2140 at current rates; the record keeping will then be rewarded by transaction fees only.[

Leave a comment